The Land Office Accounts and Fees Books list daily transactions of fees paid to the General Land Office. The Land Office Fees and Salary Accounts of Land Classifiers book also lists the salaries paid to land classifiers employed by the GLO.

An accounting day book is a simple chronological list of the day's transactions, both debits paid in cash or granted in credit. Usually accompanying a day book was the ledger that kept track of the accounts of individuals or companies granted credit.

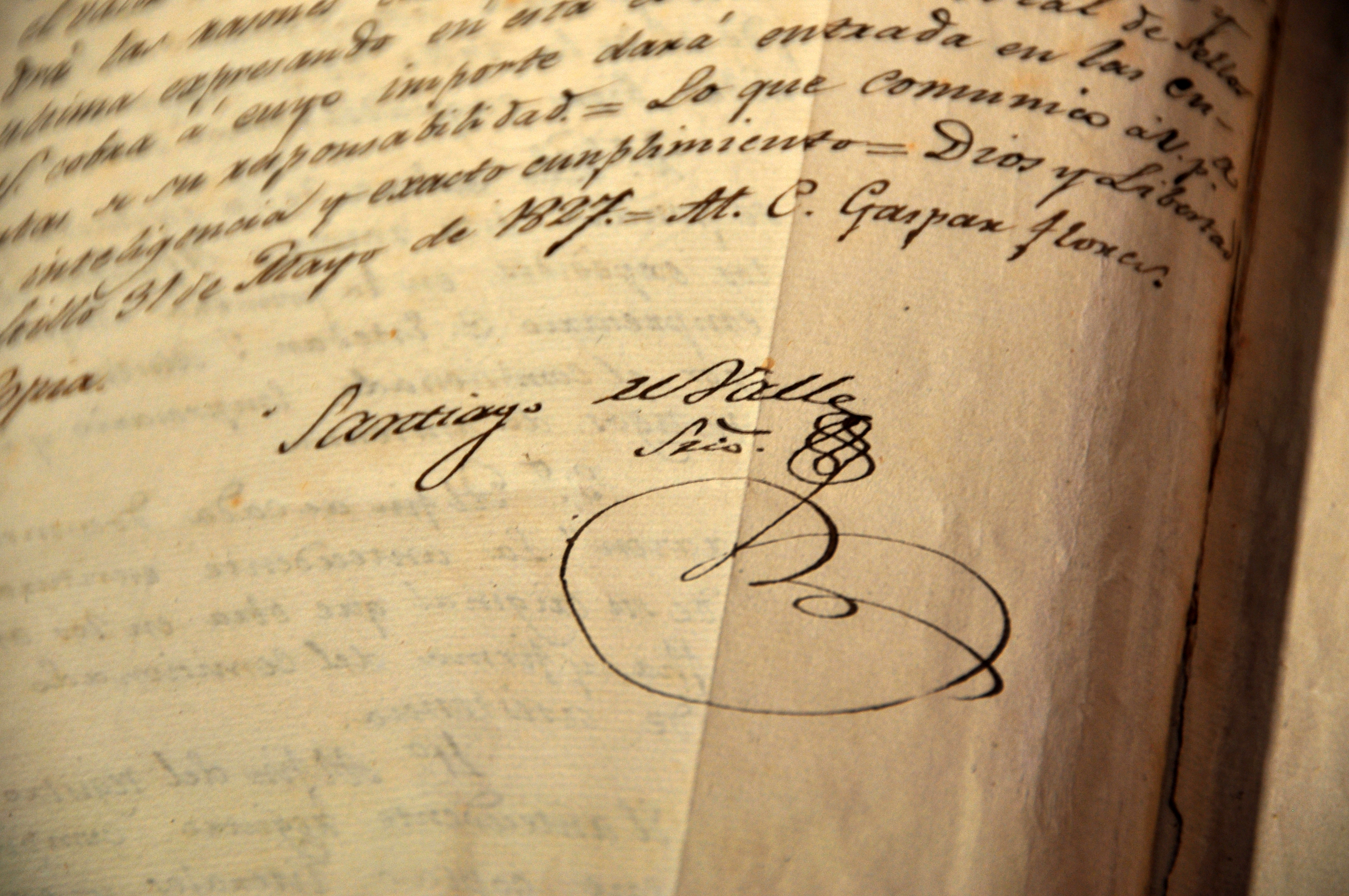

Land Office Accounts and Fees Books documents fees paid by cash or credit for services rendered. Types of fees include copies of patents delivered, patent filing fees, Spanish land grant translations, and installment payments on land purchased.

The Land Office Fees Day-Book includes a row listing the name of customer, description of fee being paid, and amount of fee. The row also includes number that may refer to the individuals section in an accounts ledger that no longer exists.

The Land Office Fees and Salary Accounts of Land Classifiers includes the name of land classifier, date paid and amount paid.

The Land Office Accounts and Fees Books are arranged in chronological order. The Land Office Fees and Salary Accounts of Land Classifiers book is split into two parts, fees, then salary accounts.

Land Office Accounts and Fees Books (LGR.DBK). Archives and Records Program, Texas General Land Office, Austin.

Unrestricted access.

Most records created by Texas state agencies are not copyrighted and may be freely used in any way. State records also include materials received by, not created by, state agencies. Copyright remains with the creator. The researcher is responsible for complying with U.S. Copyright Law (Title 17 U.S.C.).